Download Oracle E-Business Suite R12 Project Essentials.1z0-511.Pass4Success.2026-01-23.62q.tqb

| Vendor: | Oracle |

| Exam Code: | 1z0-511 |

| Exam Name: | Oracle E-Business Suite R12 Project Essentials |

| Date: | Jan 23, 2026 |

| File Size: | 452 KB |

How to open TQB files?

Files with TQB (Taurus Question Bank) extension can be opened by Taurus Exam Studio.

Purchase

Coupon: TAURUSSIM_20OFF

Discount: 20%

Demo Questions

Question 1

Identify three transactions for which Oracle Project Costing enforces budgetary controls.

- project-related purchase requisitions and purchase orders entered in Oracle Purchasing

- expense reports entered In Oracle iExpenses

- supplier invoices entered in Oracle Payables

- contingent worker purchase orders entered in Oracle Purchasing

- employee timecards entered in Oracle Time and Labor

Correct answer: A, C, D

Explanation:

Note:* Enable Budgetary Controls and Encumbrance AccountingTo use budgetary controls, you must implement budgetary control and encumbrance accounting for the ledger in Oracle General Ledger and enable encumbrance accounting in Oracle Payables or Oracle Purchasing. Encumbrance accounting automatically creates encumbrances for requisitions, purchase orders, and invoices.* PSA: Budgetary Control Report TemplateThis profile option can be set at the site, application, responsibility, and user levels. You must select Budgetary Control Results Template as the value for this profile option to enable users to view funds check results from Oracle Purchasing and Oracle Payables after a funds check. Note:

* Enable Budgetary Controls and Encumbrance Accounting

To use budgetary controls, you must implement budgetary control and encumbrance accounting for the ledger in Oracle General Ledger and enable encumbrance accounting in Oracle Payables or Oracle Purchasing. Encumbrance accounting automatically creates encumbrances for requisitions, purchase orders, and invoices.

* PSA: Budgetary Control Report Template

This profile option can be set at the site, application, responsibility, and user levels. You must select Budgetary Control Results Template as the value for this profile option to enable users to view funds check results from Oracle Purchasing and Oracle Payables after a funds check.

Question 2

A contractor is engaged to carry out a statement of work by a customer. The contract is fixed price, and milestone payments will be made based on the individual completion of agreed deliverables. The contract specifies that 10% of any invoice totals must be withheld. The exception to this rule is that if certain deliverables are met ahead of the agreed schedule, then the full amount can be invoiced. How would this scenario be set up in Oracle Projects?

- Customer Retention Billing is implemented with a Withholding Term of Expenditure Category.

- 10% of project costs is set with a billing hold (as required) in Expenditure Inquiry.

- A task is used to collect costs that are to be withholding and the task is set to non-billable as required.

- Customer Retention Billing is implemented with a Withholding Term based on Event Types.

- A customer bill split is implemented to send 10% of all invoiced costs to a dummy customer.

Correct answer: A

Explanation:

* Defining Retention TermsRetention Terms determine how amounts are withheld from project invoices and how the withheld amounts are billed to the project customer. Retention terms include:Withholding TermsWithholding Terms by Expenditure CategoryWithholding Terms by Event Revenue CategoryBilling Terms* Witholding TermsThese terms apply to all sources of project invoice amounts for the specified project or top task. For each term, you can define a withholding percentage or amount. Optionally, a threshold amount can be defined to determine the maximum amount to be withheld per term. * Defining Retention Terms

Retention Terms determine how amounts are withheld from project invoices and how the withheld amounts are billed to the project customer. Retention terms include:

Withholding Terms

Withholding Terms by Expenditure Category

Withholding Terms by Event Revenue Category

Billing Terms

* Witholding Terms

These terms apply to all sources of project invoice amounts for the specified project or top task. For each term, you can define a withholding percentage or amount. Optionally, a threshold amount can be defined to determine the maximum amount to be withheld per term.

Question 3

Company ABC wants to deploy workplan task structures where the lowest tasks represent deliverables. They want to collect costs at a level higher than the lowest tasks for groups of deliverables. Which two task structure relationships are available for them to consider?

- Define the structures as Fully Shared.

- Utilize Task-based mapping structures.

- Define a separate branch of task hierarchy for deliverables.

- Define a separate branch of task hierarchy for cost collection.

- Define the structures as Partially shared.

Correct answer: B, C

Explanation:

Note:* You can set up two types of project structures in Oracle Projects:/ Workplan structures consist of tasks that help project managers and team members plan, track, and deliver projects on time./ Financial structures consist of tasks that help project managers and financial administrators track billing, costs, budgets, and other financial information for individual projects.* If you enable both a workplan structure and a financial structure for your project or project template, you can decide whether or not they are integrated, and if so, to what degree. You do this by choosing one of the following options on the Structures setup page:/ Shared Structures: Enables you to generate a financial structure with a task hierarchy that is fully shared by the workplan structure task hierarchy. Workplan and financial structures are fully shared by default./ Partially Shared Structures: Enables you to generate a financial structure that is partially shared by the workplan structure hierarchy./ Non-Shared: Task-Based Mapping: Enables you to map individual workplan structure tasks to individual financial structure tasks./ Non-Shared: No Mapping: Choose this if you do not want to integrate your project workplan and financial structures in any way. Note:

* You can set up two types of project structures in Oracle Projects:

/ Workplan structures consist of tasks that help project managers and team members plan, track, and deliver projects on time.

/ Financial structures consist of tasks that help project managers and financial administrators track billing, costs, budgets, and other financial information for individual projects.

* If you enable both a workplan structure and a financial structure for your project or project template, you can decide whether or not they are integrated, and if so, to what degree. You do this by choosing one of the following options on the Structures setup page:

/ Shared Structures: Enables you to generate a financial structure with a task hierarchy that is fully shared by the workplan structure task hierarchy. Workplan and financial structures are fully shared by default.

/ Partially Shared Structures: Enables you to generate a financial structure that is partially shared by the workplan structure hierarchy.

/ Non-Shared: Task-Based Mapping: Enables you to map individual workplan structure tasks to individual financial structure tasks.

/ Non-Shared: No Mapping: Choose this if you do not want to integrate your project workplan and financial structures in any way.

Question 4

A company generates revenue at period end, but bills monthly in advance. The customer is invoiced in April with project starting in May and the first project is due to be recognized at the end of May. What are the accounting entries at the end of May?

- Debit: Cost of Goods SoldCredit: Unbilled Receivables

- Debit: Unearned RevenueCredit: Revenue

- Debit: ReceivableCredit: Bank

- Debit: ReceivableCredit: Unearned Revenue

- Debit: BankCredit: Revenue

Correct answer: D

Explanation:

InvoiceWhen you run the program to interface invoices to Oracle Receivables, Oracle Projects runs AutoAccounting to determine the appropriate default accounts. If the invoice fails AutoAccounting, then the program marks the draft invoice with an error. See: Overview of AutoAccounting, Oracle Projects Implementation Guide.The following table shows entries Oracle Projects creates when the Interface Invoices to Oracle Receivables process is run:Account Debit CreditReceivables 200.00Unbilled Receivables and/or Unearned Revenue 200.00Oracle Project Billing User Guide Invoice

When you run the program to interface invoices to Oracle Receivables, Oracle Projects runs AutoAccounting to determine the appropriate default accounts. If the invoice fails AutoAccounting, then the program marks the draft invoice with an error. See: Overview of AutoAccounting, Oracle Projects Implementation Guide.

The following table shows entries Oracle Projects creates when the Interface Invoices to Oracle Receivables process is run:

Account Debit Credit

Receivables 200.00

Unbilled Receivables and/or Unearned Revenue 200.00

Oracle Project Billing User Guide

Question 5

A customer wants to make a new classification mandatory on all their new projects. Select the three options that could help them accomplish this.

- Define the classification as Mandatory in the Classification configuration.

- Define the classification as Mandatory in the Project Type configuration.

- Define the classification category to allow one code only.

- Define project status controls to disallow project status changes where classification category codes are missing.

- Define the classification as Required on the appropriate project templates in the Quick Entry screen.

Correct answer: A

Explanation:

Note:* You define project classifications to group your projects according to categories you define. A project classification includes a class category and a class code. The category is a broad subject within which you can classify projects. The code is a specific value of the category.* (see step 3 below) Defining class categories and class codesTo define class categories and class codes:1. Navigate to the Class Categories and Codes window.2. Enter a unique Class Category name and a Description.3. Specify whether the class category is mandatory for every project you define.Enable if all projects must have a code assigned to this class category. Do not enable if this class category is optional. If you do not enable this option, you cannot use this class category in your AutoAccounting rules.4. Specify whether you want to use the class category in your AutoAccounting rules.Suggestion: For each project, you can use only one code with one class category for use with AutoAccounting rules. If an AutoAccounting category already exists within a particular date range, assign an end date to the existing AutoAccounting category and then create a new one.5. Specify whether you want to allow entry of only one class code with this class category for a project.Note: Defining multiple class codes for one category for a project may affect reporting by class category; defining multiple class codes may cause your numbers to be included more than once.6. Enter the Name, Description, and Effective Dates for each class code.7. Save your work. Note:

* You define project classifications to group your projects according to categories you define. A project classification includes a class category and a class code. The category is a broad subject within which you can classify projects. The code is a specific value of the category.

* (see step 3 below) Defining class categories and class codes

To define class categories and class codes:

1. Navigate to the Class Categories and Codes window.

2. Enter a unique Class Category name and a Description.

3. Specify whether the class category is mandatory for every project you define.

Enable if all projects must have a code assigned to this class category. Do not enable if this class category is optional. If you do not enable this option, you cannot use this class category in your AutoAccounting rules.

4. Specify whether you want to use the class category in your AutoAccounting rules.

Suggestion: For each project, you can use only one code with one class category for use with AutoAccounting rules. If an AutoAccounting category already exists within a particular date range, assign an end date to the existing AutoAccounting category and then create a new one.

5. Specify whether you want to allow entry of only one class code with this class category for a project.

Note: Defining multiple class codes for one category for a project may affect reporting by class category; defining multiple class codes may cause your numbers to be included more than once.

6. Enter the Name, Description, and Effective Dates for each class code.

7. Save your work.

Question 6

You have imported Labor transactions into Oracle Projects from Oracle Time and Labor by running the "PRC: Transaction Import" program. What is the correct sequence to run the concurrent programs listed below to transfer the cost and accounting entries of these transactions to General Ledger?

- PRC: Distribute Labor Cost

- PRC: Transfer Journal Entries to GL

- PRC: Create Accounting (with the Transfer to GL option set to "No")

- PRC: Interface Labor Costs to GL

- PRC: Generate Cost Accounting Events

- PRC: Distribute and Interface tabor costs to GL

- 1, 3, 6

- 1, 5, 3, 4

- 1, 5, 3, 2

- 1, 2

- 3, 6

Correct answer: C

Explanation:

The following activities take place as part of the expenditures process flow for labor costs:1. Run the process PRC: Distribute Labor Costs. This process calculates the raw and burden cost components for labor cost expenditure items. It also uses AutoAccounting to determine the default debit account for each expenditure item.2. Run the process PRC: Generate Cost Accounting Events. This process uses AutoAccounting to determine the default credit account for each expenditure item. It also generates accounting events for distributed transactions. You can optionally select Labor Cost as the process category to limit the process to labor costs.3. Run the process PRC: Create Accounting. This process creates subledger journal entries for eligible accounting events. You can run the process in either draft or final mode. You can optionally select Labor Cost as the process category to limit the process to labor cost accounting events. Optionally, the process can post journal entries in Oracle General Ledger.If you define your own detailed accounting rules in Oracle Subledger Accounting, then Oracle Subledger Accounting overwrites default accounts, or individual segments of accounts, that Oracle Projects derives using AutoAccounting.4. Run the process PRC: Transfer Journal Entries to GL. When you run the process PRC: Create Accounting, if you select No for the parameter Transfer to GL, then you run the process PRC: Transfer Journal Entries to GL to transfer the final subledger journal entries from Oracle Subledger Accounting to Oracle General Ledger. You can optionally select Labor Cost as the process category to limit the process to labor cost accounting events. Optionally, the process can post journal entries in Oracle General Ledger.5. Run Journal Import in Oracle General Ledger. (optional) This process brings the final accounting entries from Oracle Subledger Accounting into Oracle General Ledger. The following activities take place as part of the expenditures process flow for labor costs:

1. Run the process PRC: Distribute Labor Costs. This process calculates the raw and burden cost components for labor cost expenditure items. It also uses AutoAccounting to determine the default debit account for each expenditure item.

2. Run the process PRC: Generate Cost Accounting Events. This process uses AutoAccounting to determine the default credit account for each expenditure item. It also generates accounting events for distributed transactions. You can optionally select Labor Cost as the process category to limit the process to labor costs.

3. Run the process PRC: Create Accounting. This process creates subledger journal entries for eligible accounting events. You can run the process in either draft or final mode. You can optionally select Labor Cost as the process category to limit the process to labor cost accounting events. Optionally, the process can post journal entries in Oracle General Ledger.

If you define your own detailed accounting rules in Oracle Subledger Accounting, then Oracle Subledger Accounting overwrites default accounts, or individual segments of accounts, that Oracle Projects derives using AutoAccounting.

4. Run the process PRC: Transfer Journal Entries to GL. When you run the process PRC: Create Accounting, if you select No for the parameter Transfer to GL, then you run the process PRC: Transfer Journal Entries to GL to transfer the final subledger journal entries from Oracle Subledger Accounting to Oracle General Ledger. You can optionally select Labor Cost as the process category to limit the process to labor cost accounting events. Optionally, the process can post journal entries in Oracle General Ledger.

5. Run Journal Import in Oracle General Ledger. (optional) This process brings the final accounting entries from Oracle Subledger Accounting into Oracle General Ledger.

Question 7

An organization posts project costs to the balance sheet as they are incurred. Each month they recognize project revenue on each project. Select the option that ensures that costs are credited from the balance sheet and debited to profit and loss as revenue is recognized.

- Use events for project revenue and use GL journals to carry out the relevant account postings.

- Implement a project revenue extension with appropriate event types and AutoAccounting definition.

- Use miscellaneous transactions to generate revenue with the appropriate AutoAccounting definition.

- Use preapproved batches with a class type of 'Work in Process' to generate revenue with the appropriate AutoAccounting definition.

Correct answer: B

Question 8

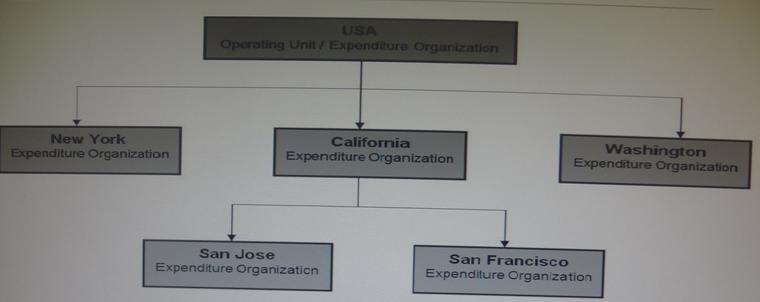

Refer to the exhibit.

In your company's Expenditure/Event Organization Hierarchy, organization labor costing rules are assigned to all organizations except San Jose. What happens when you run the "PRC: Distribute labor costs" program for a timecard transaction entered by an employee from the San Jose organization?

- The rule assigned for San Francisco takes precedence and the transaction will he successfully a distributed.

- The rule assigned for USA takes precedence and the transaction will he successfully cost distributed.

- The rule assigned for California takes precedence and the transaction will be successfully cost distributed.

- The program ignores this transaction, because no labor costing rule is assigned for San Jose. and completes normally.

- The program completes normally. However, the output will have this transaction under the exceptions section with a message 'No Labor costing rule assigned for organization.'

Correct answer: C

Question 9

What type of project will a company require to use Organization Forecasting?

- contract project

- Administration Project

- Organization Planning Project

- capital project

- multi-function project

Correct answer: A

Explanation:

Note:* Compute Forecast Labor RevenueThis process calculates the potential revenue of labor expenditure items based on established bill rates and markups. The expenditure items that the process selects are billable labor expenditure items charged to contract projects that have not yet been processed by the Generate Draft Revenue process. The items do not have to be approved to be processed for forecast revenue. Note:

* Compute Forecast Labor Revenue

This process calculates the potential revenue of labor expenditure items based on established bill rates and markups. The expenditure items that the process selects are billable labor expenditure items charged to contract projects that have not yet been processed by the Generate Draft Revenue process. The items do not have to be approved to be processed for forecast revenue.

Question 10

A one-time additional public holiday has been announced for this year. You update the PA Calendar, which is used for Resourcing with this exception. Select the two options required to ensure that this change is reflected in the existing assignment on resource calendars.

- Run 'PRC: Generate Calendar Schedules.'

- Run 'PRC: Rebuild Resource Timeline.'

- Inform Resource Managers that they will have to redo all the existing planning.

- Run 'PRC: Automated Candidate Search.'

- Run 'PRC: Refresh project summary amounts.'

Correct answer: A, B

Explanation:

Changes to these calendars impact the schedules of the person resources, requirements, and assignments differently. Oracle Project Resource Management provides the following administrative processes to help manage these changes and to maintain consistent schedule information throughout the application:PRC: Generate Calendar Schedule for a Single CalendarPRC: Generate Calendar Schedules for a Range of CalendarsPRC: Rebuild Timeline for a Single ResourcePRC: Rebuild Timeline for a Range of Resources Changes to these calendars impact the schedules of the person resources, requirements, and assignments differently. Oracle Project Resource Management provides the following administrative processes to help manage these changes and to maintain consistent schedule information throughout the application:

PRC: Generate Calendar Schedule for a Single Calendar

PRC: Generate Calendar Schedules for a Range of Calendars

PRC: Rebuild Timeline for a Single Resource

PRC: Rebuild Timeline for a Range of Resources

HOW TO OPEN VCE FILES

Use VCE Exam Simulator to open VCE files

HOW TO OPEN VCEX FILES

Use ProfExam Simulator to open VCEX files

ProfExam at a 20% markdown

You have the opportunity to purchase ProfExam at a 20% reduced price

Get Now!